infrastructure investment and jobs act tax provisions

Infrastructure Investment and Jobs Act Tax Provisions. House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known as the bipartisan infrastructure bill.

Infrastructure Investment And Jobs Act Iija Implementation Resources

The vote was 228 to 206.

. The BBBA could have significant provisions regarding the Child Tax Credit the cap on the state and local tax deduction and limits on the business interest expense deduction. The Infrastructure Investment and Jobs Act signed by the President on Nov. Tax-related provisions in the Infrastructure Investment and Jobs Act.

The majority of the Democrats proposed tax law changes to the extent they survive ongoing negotiations will be included in the Build Back Better Act BBBA. Almost three months after it passed the US. Thus congressional action of this bill has been.

While the bulk of the law is directed toward massive. The act first passed by the Senate in August was passed by the House on Nov. The Infrastructure Investment and Jobs Act will end the Employee Retention Tax Credit early and create new workforce development.

House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known as the bipartisan infrastructure bill. 3684 the Infrastructure Investment and Jobs Act. 3684 the Infrastructure Investment and Jobs Act.

Gain or income derived from the sale or assignment of certain tax credit transfer certificates is. The Act requires the submission of a copy of the resolution certifying an Emergent Condition and this document identifies the recommended supporting information will that aid DEP in rendering a timely decision. Infrastructure Investment and Jobs Act.

One way the Democrats got Republican buy-in is that early on they substituted tax increases with compliance measures to fund the bill although the. House of Representatives tonight passed HR. Almost three months after it passed the US.

Roads bridges and major projects. Specific default provisions of the Act have been highlighted below to give a sense of what rights and obligations are guaranteed to shareholders of a New Jersey LLC. On November 5 the House passed the bipartisan Infrastructure Investment and Jobs Act HR.

Federal requirements for TIFIA eligibility and project selection. Almost three months after it passed the US. 5 2021 with an estimated cost of 12 trillion.

This title extends several highway-related authorizations and tax provisions including. Last weeks approval of the more than 1 trillion Infrastructure Investment and Jobs Act IIJA which includes a couple of tax provisions for taxpayers to take note of is on its way to President Bidens desk for his anticipated signature. The expenditure authority for the Highway Trust Fund through FY2026 the.

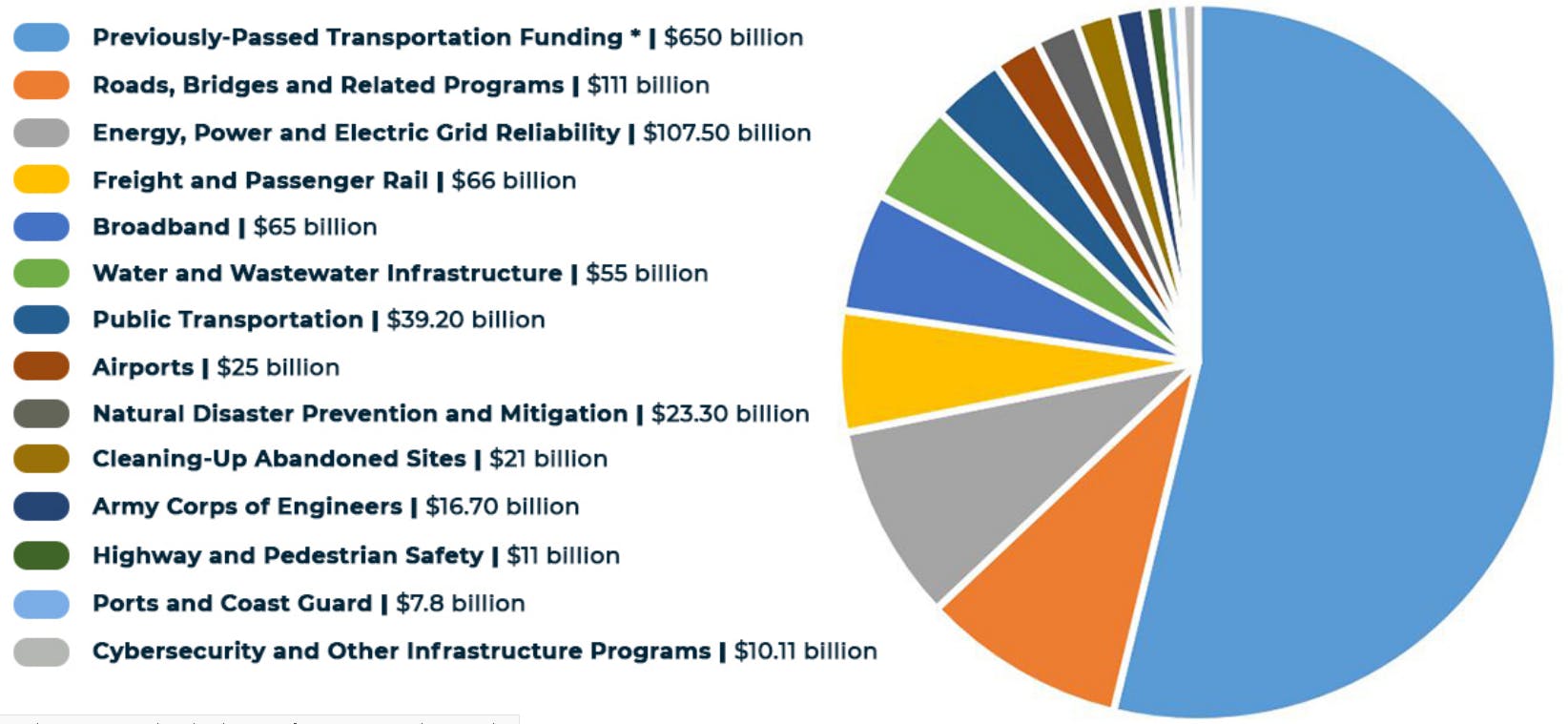

The legislation includes tax-related provisions. 3684 by a vote of 228-206 with the support of 13 RepublicansThe Senate passed the bill in August 2021 also with bipartisan support. Among other provisions this bill provides new funding for infrastructure projects including for.

On November 15 in a bipartisan ceremony President Biden signed into law HR. An LLC is member-managed unless the operating agreement expressly provides it will be manager-managed or managed by managers NJ. Active transportation infrastructure investment program.

Both UPMIFA and UMIFA provide rules for how certain wholly charitable institutions including hospitals universities and their foundations should make investment decisions. Kleiman November 11 2021. 15 2021 presents a number of issues for taxpayers to consider.

New Jersey recently adopted the Uniform Prudent Management of Institutional Funds Act UPMIFA replacing the 1975 Uniform Management of Institutional Funds Act UMIFA. Although the act includes fewer tax provisions than originally introduced. Senate passed the same version of the bill on August 10 2021 on a bipartisan basis.

While the bulk of the law is directed toward massive investment in infrastructure projects across the country a handful of noteworthy tax provisions are tucked. TITLE II--TRANSPORTATION INFRASTRUCTURE FINANCE AND INNOVATION Sec. Transportation Infrastructure Finance and Innovation Act of 1998 amendments.

On January 16 2018 Governor Christie signed Senate Bill 3305 S33051 modifying New Jerseys tax credit transfer provisions under the Grow New Jersey Assistance Act and the Public Infrastructure Tax Credit Program as follows. Its duties under the Water Infrastructure Protection Act WIPA or the Act in reviewing a Municipal Certification of Emergent Conditions. House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known as the bipartisan infrastructure bill.

Highway cost allocation study. New EV Provisions in the Infrastructure Investment and Jobs Act In November 2021 President Biden signed the 12 trillion bipartisan Infrastructure Investment and. While the bulk of the law is directed toward massive investment in infrastructure projects across the country a handful of noteworthy tax.

Don T Overlook These Essential Small Business Tax Credits Small Business Tax Business Tax Tax Credits

Here S How Biden S Build Back Better Framework Would Tax The Rich

How States Can Use The Bipartisan Infrastructure Law To Enhance Their Climate Action Efforts Center For American Progress

Myths And Facts Infrastructure Investment Jobs Act

Senator Bipartisan Infrastructure Bill Loses Irs Provision Ap News

Don T Overlook These Essential Small Business Tax Credits Small Business Tax Business Tax Tax Credits

New Infrastructure Law To Provide Billions To Energy Technology Projects American Institute Of Physics

What Is In The Bipartisan Infrastructure Legislation Npr

Don T Overlook These Essential Small Business Tax Credits Small Business Tax Business Tax Tax Credits

The Tangled Tale Of The Infrastructure Bill Crypto Reporting And Taxes

Factbox Roads Bridges And Airports Details Of Biden S 1 Trillion Infrastructure Bill Reuters

Myths And Facts Infrastructure Investment Jobs Act

Books Books And More Books Etc

Green Energy Investors Neglect Human Rights Risks In China Analyst Says Renewable Energy Resources Renewable Energy International Energy Agency

4 Mistakes Managers Make When Building A Sales Team Home Business Business Development Learning And Development

Engaged Quality Outsourcing Sixeleven

Biden Signs 1 Trillion Bipartisan Infrastructure Bill Into Law